Case Note & Summary

1. Introduction of Case (Paras 1-3):

The applicant sought pre-arrest bail in connection with Crime No. 02 of 2024 registered at Azadnagar Police Station, Dhule. The charges are under Sections 419, 420, 341, 170, 201, 120(B), and 34 of the IPC. The case revolves around a group impersonating GST officers, stopping trucks, demanding GST receipts, and extorting money. They used fake accounts and involved government police vehicles in the fraudulent activities.

2. Applicant's Arguments (Paras 4-5): Para 4: The applicant’s counsel argued that the alleged offenses are punishable up to seven years and hence, compliance with Section 41A CrPC was mandatory. The counsel cited Satender Kumar Antil v. CBI and Arnesh Kumar v. State of Bihar as precedents, urging for interim protection and claiming no material evidence directly connects the applicant. Para 5: The learned APP opposed the bail, emphasizing the applicant’s involvement in a serious crime. There were numerous inter-se calls among accused, and fake bank accounts were used for illegal transactions. The offense is of an intellectual nature, and custodial interrogation is crucial for a proper investigation. 3. Legal Provisions Discussed (Paras 6-9): Para 6-7: The Court considered whether notice under Section 41A CrPC is mandatory in every case. Section 41 CrPC outlines conditions where arrest without a warrant is permissible, especially for cognizable offenses. Para 8-9: The Court referenced Satender Kumar Antil and Arnesh Kumar judgments. It reiterated that arrest is not automatic for offenses with imprisonment less than seven years unless deemed necessary for proper investigation, preventing further crimes, or ensuring court presence. 4. Analysis of Compliance with Sections 41 and 41A CrPC (Paras 10-13): Para 10-12: The Court highlighted the duty of police officers to justify arrests and record reasons in writing. Compliance with Sections 41 and 41A is mandatory, and non-compliance could lead to bail being granted. Para 13: It was clarified that Section 41A notice is not mandatory unless the investigation officer concludes arrest is unnecessary. In this case, the applicant’s arrest was deemed necessary for preventing evidence tampering and ensuring proper investigation. 5. Court's Reasoning for Dismissal (Paras 14-15): Para 14: The Court found that the applicant’s pre-arrest bail plea was premature. The applicant had avoided arrest, and his involvement in the crime was evident. The nature of the offense, involvement of police personnel, and misuse of official vehicles justified arrest. Para 15: The charge sheet was filed, and the applicant was shown as absconding. The Court agreed with the APP that custodial interrogation was essential, and anticipatory bail could obstruct the investigation. Hence, the application for pre-arrest bail was dismissed. Acts and Sections Discussed: Indian Penal Code: Sections 419 (Cheating by impersonation), 420 (Cheating), 341 (Wrongful restraint), 170 (Impersonating public servant), 201 (Causing disappearance of evidence), 120(B) (Criminal conspiracy), 34 (Acts done by several persons in furtherance of common intention). Criminal Procedure Code: Section 41 (When police may arrest without a warrant), Section 41A (Notice of appearance before police officer). Ratio Decidendi: The Supreme Court's judgments in Satender Kumar Antil v. CBI and Arnesh Kumar v. State of Bihar were cited by the applicant but deemed inapplicable due to the seriousness of the crime and the necessity of arrest for proper investigation. Custodial interrogation is required to collect evidence, prevent tampering, and safeguard the investigation's integrity in serious fraud cases. Subjects:Criminal Law, Bail, Impersonation, Fraud

Anticipatory Bail, Pre-arrest Bail, GST Impersonation Fraud, Section 41 and 41A CrPC, Custodial Interrogation, Cheating, Criminal Conspiracy

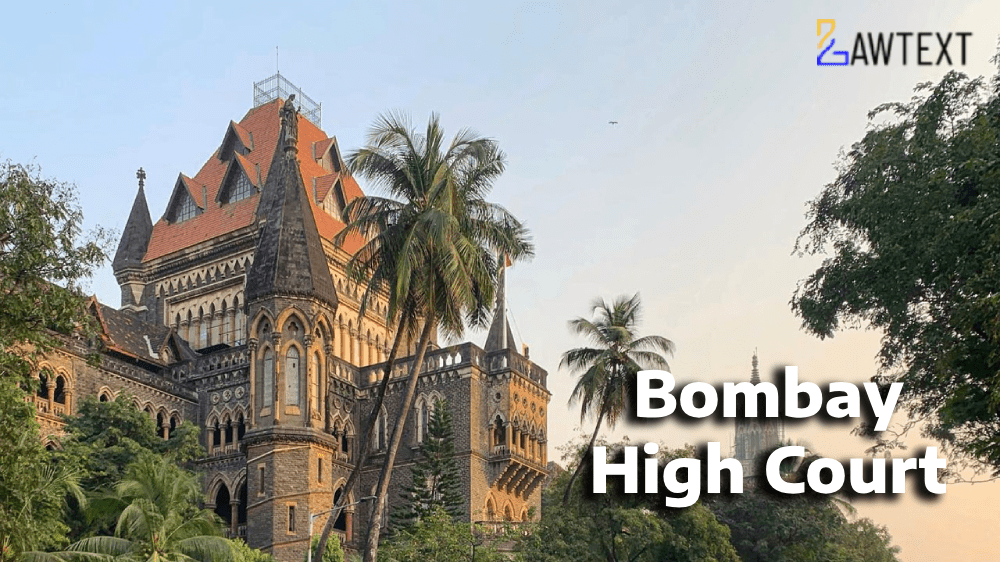

Issue of Consideration: Anand s/o Sukhlal Pardeshi Versus The State Of Maharashtra

Premium Content

The Issue of Consideration is only available to subscribed members.

Subscribe Now to access critical case issues