Case Note & Summary

Appeal against a judgment and award passed by the Motor Accident Claim Tribunal regarding a compensation claim under the Motor Vehicle Act. The appellant, an insurer, challenges the decision based on the cancellation of the insurance policy. The core issue revolves around whether the policy was in force at the time of the accident and if the cancellation was properly communicated. The appellant fails to provide substantial evidence of the policy cancellation, leading to the dismissal of the appeal.

Introduction: The appellant challenges a judgment and award by the Motor Accident Claim Tribunal (MACT) regarding a compensation claim. Consent for Final Hearing: The parties agree to proceed with the final hearing. Appellant's Submission: The appellant's advocate argues that the insurance policy for the vehicle involved in the accident was cancelled before the incident, relieving the insurer of liability. Respondent's Counterargument: The respondent's advocate contends that the cancellation plea was not adequately raised or supported with evidence during the tribunal proceedings. Core Issue: The central question is whether the insurance policy was active at the time of the accident and if the cancellation was properly substantiated. Analysis of Evidence: The evidence presented, highlighting the lack of substantial proof from the insurer regarding the policy cancellation. Legal Precedent: Reference is made to a Supreme Court case emphasizing the importance of properly communicating policy cancellations before accidents to absolve insurers of liability. Dismissal of Appeal: Due to the insufficient evidence provided by the appellant, the appeal is dismissed, and costs may be incurred. Disposition of Funds: Any deposited amount related to the appeal is to be released in favor of the claimants. Conclusion: The dismissal of the appeal and the resolution of any pending civil applications.

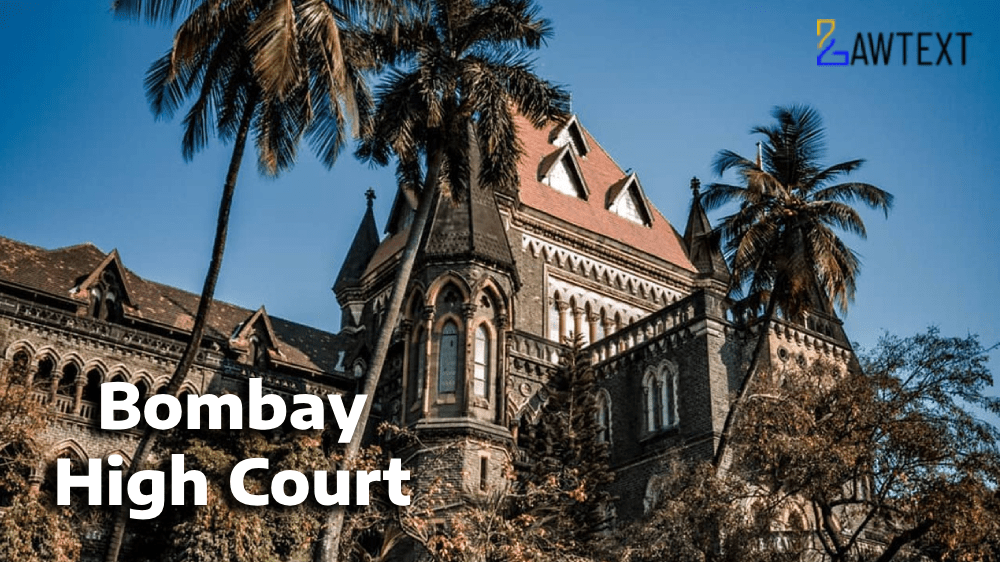

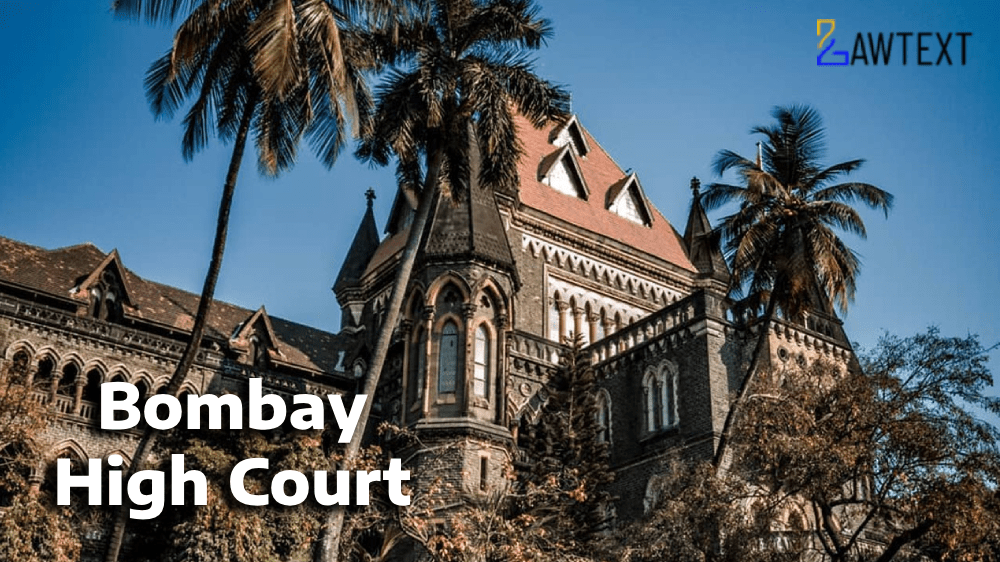

Issue of Consideration: The New India Assurance Co. Ltd. Versus Sow. Shantabai w/o Bhausaheb Bidve Ors.

Premium Content

The Issue of Consideration is only available to subscribed members.

Subscribe Now to access critical case issues