Case Note & Summary

Legal petition filed by the Pen Municipal Council challenging a judgment from the Industrial Court regarding the regularization of an employee, identified as Respondent No.1, to the position of Tax Inspector. The Council contests the regularization order, arguing that the employee lacked qualifications and was appointed temporarily without proper selection procedures. The petition presents arguments, counter-arguments, legal precedents, and analysis surrounding the dispute over the regularization of the employee's services.

Introduction and Legal Context

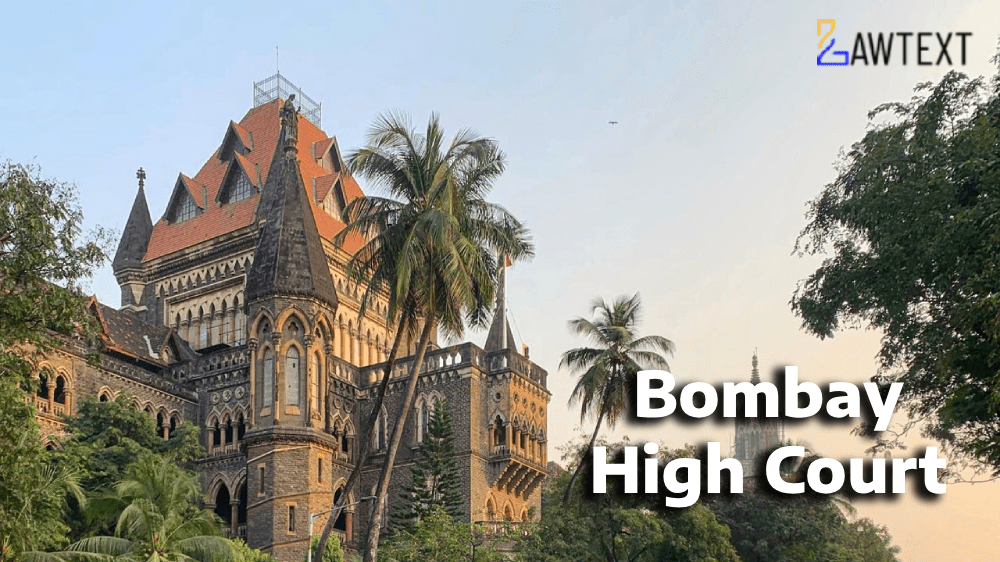

Introduces the case concerning the regularization of an employee's service in a Municipal Council. Mentions the legal framework and relevant precedents, including judgments from the Supreme Court of India.Reference to Legal Precedents

Citations from Supreme Court judgments like MSRTC Vs. Casteribe Rajya Parivahan Karmachari Sanghatana and Hari Nandan Prasad Vs. Employer I/R to Management of Food Corporation of India establish legal principles governing regularization of service.Recent Supreme Court Decision (Vinod Kumar & Ors. vs. Union of India & Ors.)

Discusses a recent Supreme Court decision relevant to the case. Highlights the ruling regarding employment rights essence and reclassification of temporary to regular status based on continuous service.Facts of the Present Case

Detailed chronology of events regarding the appointment and service of Respondent No.1 in the Municipal Council. Discussion on circumstances of the respondent's appointment, including the sanctioning of the Tax Inspector post and the selection process.Analysis and Conclusion

Analyzes presented facts in the case considering legal principles and precedents. Critiques defenses raised by the Municipal Council before the Industrial Court. Applies the recent Supreme Court ruling (Vinod Kumar case) to justify regularization of the respondent's service. Concludes by affirming the Industrial Court's decision to allow the complaint filed by the respondent. Dismisses the writ petition with no orders as to costs and discharges the rule.Legal analysis emphasizing equity, fairness, and legality in determining the regularization of the employee's service in the Municipal Council.

Issue of Consideration: The Chief Officer Pen Municipal Council V/S Shekhar B. Abhang Ors.

Premium Content

The Issue of Consideration is only available to subscribed members.

Subscribe Now to access critical case issues