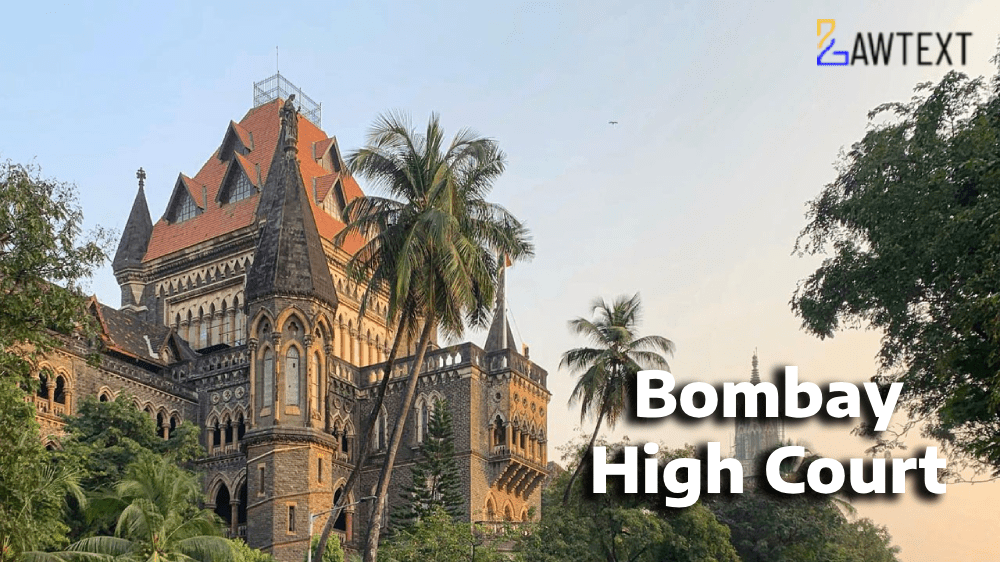

Case Note & Summary

The Bombay High Court upheld the acquittal of Smt. Ameenabi, accused of possessing contraband gold under the Customs Act, 1962, and the Gold (Control) Act, 1968. The court emphasized the lack of corroborative evidence, the absence of independent witnesses, and procedural inconsistencies in the prosecution's case.

Background FactsCase Origin:

Date: 04 February 1988 Accused: Smt. Ameenabi, alleged possession of 100 gold bars (weighing 11,660 grams) at her Mumbai residence. Statutes Violated: Customs Act, 1962, and Gold (Control) Act, 1968.Incident Details:

DRI raided her premises based on information linking her to smuggler Afzal Weldon, her brother. Contraband gold seized following a search where Ameenabi was alleged to have attempted to dispose of evidence. Prosecution’s Case Gold bars were retrieved and seized by DRI officers. Samples confirmed purity under government assay. Confessional statements implicated Ameenabi as acting under her brother's instructions to store gold. Defense and Trial Court JudgmentDefense highlighted:

The confessional statement was retracted, claiming coercion and threats to harm her minor son. Procedural lapses, including non-examination of independent witnesses.Trial Court Observations:

Evidence lacked corroboration from independent witnesses. No conclusive proof of Ameenabi's sole occupancy of the premises. Benefit of doubt extended to the accused. Appellate Court's ObservationsCorroboration Requirement:

Sole reliance on confessional statements deemed insufficient. Independent witnesses were absent, raising doubts about the raid’s credibility.Retracted Confession:

Not admissible unless proven voluntary and corroborated.Prosecution’s Shortcomings:

Failed to prove conscious possession of contraband gold beyond a reasonable doubt.Acquittal Justified:

Evidence was not substantial to overturn acquittal. Ratio Decidendi:The judgment reinforced that criminal cases demand proof beyond a reasonable doubt. Procedural integrity, corroborative evidence, and voluntariness of confessions are critical for establishing guilt under the Customs Act and the Gold (Control) Act.

Relevant Acts and Sections:Customs Act, 1962:

Section 135(1)(b): Punishment for smuggling or conscious possession of contraband. Section 108: Confession statements before customs officials.Gold (Control) Act, 1968:

Section 8(1): Restrictions on possession of primary gold. Section 85(1)(ii): Penalty for unauthorized possession. Subjects:Procedural Lapses in Prosecution of Gold Smuggling CasesAcquittal, Customs Act, Gold Control Act, Criminal Procedure, Evidence Law, Smuggling, Appellate Review.

Issue of Consideration: Union Of India At The Instance Of Assistant Director, DRI, Mumbai Versus Smt. Ameenabi and Another

Premium Content

The Issue of Consideration is only available to subscribed members.

Subscribe Now to access critical case issues