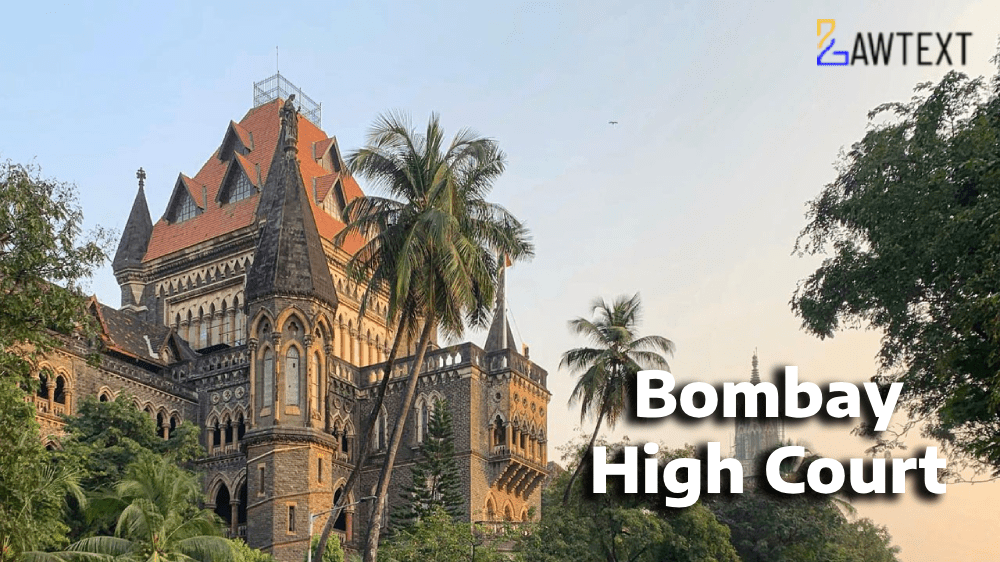

Case Note & Summary

The petitioner, against the rejection of his plaint by the Commercial Court under Order 7 Rule 11 CPC on grounds of being barred by Section 34 of the SARFAESI Act, 2002. The High Court of Bombay at Goa ruled in favor of the petitioner, restoring his suit and concluding that claims involving fraud and collusion could bypass the SARFAESI Act’s bar on civil suits.

1. Parties Involved (Para 1-3)

The petitioner, Shashikant Gangar, a director and shareholder of respondent company Libox Chem (India) Pvt. Ltd., challenges actions by Aditya Birla Finance Ltd. and other respondents regarding a loan transaction allegedly based on fraud and collusion.2. Case History (Para 4-6)

Mr. Gangar originally filed Commercial Suit No. 2/2023 at Ponda, challenging a loan sanctioned without his knowledge. Respondent No. 1, Aditya Birla Finance Ltd., filed for rejection of the plaint under Order 7 Rule 11 citing that the case was barred by Section 34 of the SARFAESI Act.3. Alleged Fraud and Collusion (Para 7-14)

Petitioner claimed that respondents (co-directors of the company) colluded with the bank to obtain a loan in 2020 without a proper board resolution, leading to the siphoning of company funds. Fraud was alleged in the sanctioning of the loan and creation of a mortgage without the required approval from the petitioner.4. Legal Proceedings (Para 15-19)

The petitioner approached the NCLT Mumbai under Sections 241 and 242 of the Companies Act for mismanagement of the company. Simultaneously, a loan was granted to respondents without the petitioner’s consent, violating the company’s regulations.5. Action by SARFAESI (Para 20-25)

Following defaults on the loan, the bank initiated proceedings under SARFAESI to take possession of secured assets. Despite the petitioner’s intervention, the Additional Collector South Goa allowed the bank’s application under Section 14 of the SARFAESI Act, directing the bank to take possession of the assets.6. DRT Proceedings and Appeal (Para 26-32)

The petitioner filed an appeal before the Debts Recovery Tribunal (DRT) under Section 17 of the SARFAESI Act, which was dismissed as the tribunal found the petitioner, being a shareholder, had no locus standi. An appeal to the Debt Recovery Appellate Tribunal (DRAT) was later withdrawn.7. Rejection of Suit & Commercial Court’s Decision (Para 33-36)

The Commercial Court ruled that the petitioner’s suit was barred under Section 34 of the SARFAESI Act, dismissing the plaint. This decision was upheld by the First Appellate Court.8. High Court's Analysis on Fraud (Para 37-48)

The High Court recognized specific pleadings of fraud and collusion by the petitioner and held that such cases of fraud are outside the scope of the SARFAESI Act, allowing civil court jurisdiction. The claim of the petitioner’s exclusion in the loan sanction process without a board resolution indicated possible fraud, a matter requiring civil court examination.9. Jurisdiction & SARFAESI Bar (Para 49-53)

Citing the case of Mardia Chemicals Ltd. v. Union of India, the Court emphasized that fraud allegations are exceptions to the SARFAESI bar under Section 34. Therefore, the petitioner was entitled to pursue his claim in a civil court.10. Decision to Restore the Suit (Para 84-85)

The Court quashed both the Commercial Court’s and First Appellate Court’s orders, restoring the suit to be tried in accordance with law, as the fraud claim provided an exception to the jurisdictional bar under the SARFAESI Act. Acts and Sections Discussed: Order 7 Rule 11 of CPC – Rejection of plaint based on being barred by law. Section 34 of the SARFAESI Act, 2002 – Bar on jurisdiction of civil courts in matters covered by the SARFAESI Act. Sections 241 & 242 of the Companies Act, 2013 – Provisions related to mismanagement and oppression in a company. Section 13(4) and Section 17 of the SARFAESI Act – Steps for recovery of loans by secured creditors and recourse available for aggrieved parties. Ratio Decidendi: The Bombay High Court ruled that claims of fraud and collusion, when specifically pleaded, fall outside the scope of the SARFAESI Act’s bar on civil jurisdiction. Such claims must be adjudicated in civil courts. Subjects:Fraud, Collusion, SARFAESI Act, Corporate Mismanagement

Fraud, SARFAESI Act, Civil Court Jurisdiction, Loan Mismanagement, Commercial Court, Debts Recovery Tribunal

Issue of Consideration: Mr. Shashikant Gangar Versus Aditya Birla Finance Limited & Ors.

Premium Content

The Issue of Consideration is only available to subscribed members.

Subscribe Now to access critical case issues